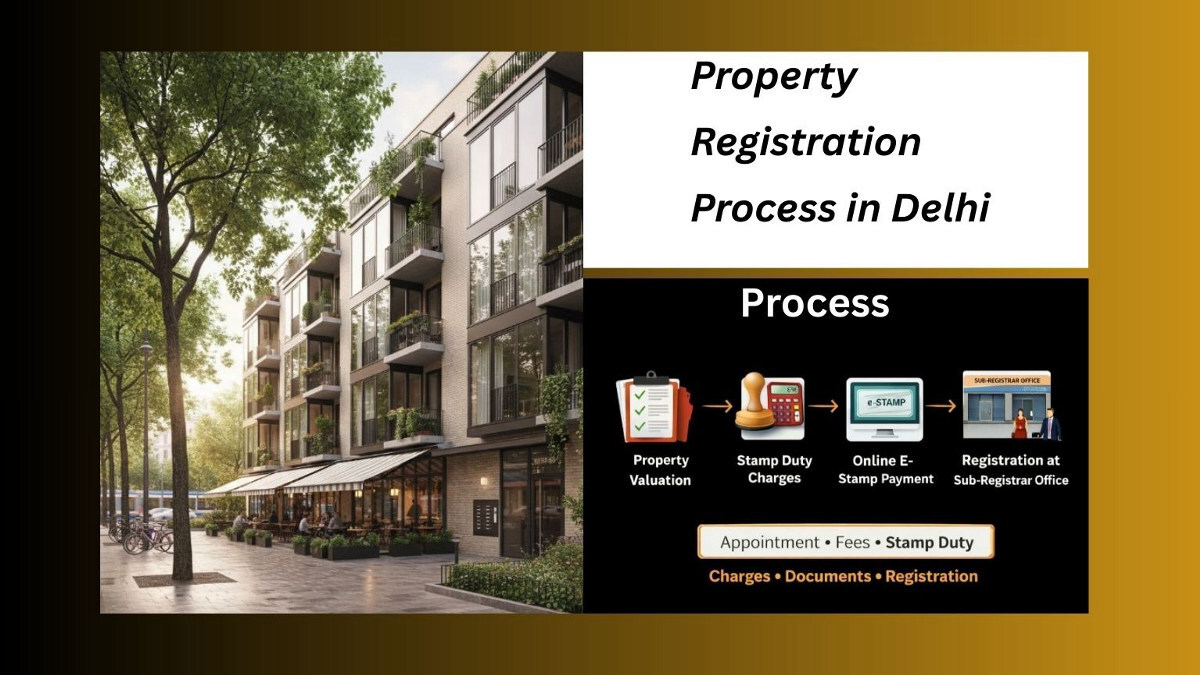

Property Registration Process in Delhi | Documents & Stamp Duty (2026)

Registration is the final seal of ownership. In Delhi, a property deal isn't "done" until the Sub-Registrar says it's done. Whether you bought a DDA flat in Rohini, a builder floor in Chatarpur, or a luxury apartment in South Delhi, the process is a mix of digital appointments and physical chaos.

The Delhi government has digitized much of the process through the DORIS (Delhi Online Registration Information System) portal, but the "human element" (read: bureaucracy) remains. This guide walks you through the entire process, from the document prep to the final handshake at the SRO, with a reality check on what actually happens inside those government walls.

1. The "Circle Rate" vs. "Market Rate" Reality

Before you calculate your budget, understand the concept of Circle Rates. This is the government's "minimum price list" for land in Delhi.

- Circle Rate: The minimum value of the property fixed by the Delhi Government for paying tax.

- Market Rate: The actual price you pay to the seller.

The Rule: You have to pay Stamp Duty on whichever is HIGHER.

Delhi's Colony Categories (A to H)

Delhi is divided into categories based on "poshness." This determines your Circle Rate.

- Category A (e.g., Vasant Vihar, Jor Bagh): Highest Circle Rates (approx ₹7.74 Lakh per sq. meter). Buying here means a massive Stamp Duty bill.

- Category H (e.g., Unauthorized Regularized Colonies): Lowest rates (approx ₹23,000 per sq. meter).

Warning: If you pay a large "cash" (black) component to show a lower registered value, you are creating a future tax nightmare. When you sell this property 10 years later by cheque, you will pay massive Capital Gains Tax. Always aim for full white payments, especially if you are taking a home loan.

2. Stamp Duty in Delhi (2026 Rates)

Delhi encourages female property ownership with a direct discount. This is why many husbands register property in their wife's name.

| Owner Gender |

Stamp Duty |

Registration Fee |

Municipal Transfer Duty |

| Male |

6% |

1% + ₹100 |

Included in 6% |

| Female |

4% |

1% + ₹100 |

Included in 4% |

| Joint (Male + Female) |

5% |

1% + ₹100 |

Included in 5% |

Note: The Registration Fee is fixed at 1% of the deal value, regardless of gender.

3. The Document Checklist (Don't Miss One)

The SRO (Sub-Registrar Office) officers are trained to find faults. If one paper is missing, your appointment is cancelled, and you have to re-book (which might take weeks). Ensure you have:

- Original Sale Deed: Drafted by a competent advocate. Avoid "Deed Writers" sitting outside the office who use outdated templates. A single typo in the name can cause rejection.

- NOC (No Objection Certificate): Required for agricultural land or specific zones. (Not usually needed for DDA freehold flats).

- Two Witnesses: Both must be physically present. They must carry original Aadhaar and PAN cards.

Tip: Don't use family members as witnesses if possible; use friends or neighbors. Family members can be challenged in court later in case of property disputes.

- Identity Proofs: Original Aadhaar and PAN of Buyer and Seller.

- TDS Certificate (Form 26QB): If property value is > ₹50 Lakhs, you must show proof that you deducted 1% TDS and paid it to the government. Without this, they won't register. See our Resale Guide for more on TDS.

- e-Stamp Paper: The proof of stamp duty payment.

- Mutation Status: Previous mutation documents of the seller to prove they are the recorded owner.

- Passport Size Photos: Carry at least 4-5 recent color photos of Buyer and Seller.

4. The Online Appointment (DORIS System)

You cannot just walk into the SRO. You must use the DORIS portal. It works, but it can be glitchy.

Step 1: Prepare the Deed

Draft the Sale Deed legally. Don't print it yet on stamp paper until verified by your lawyer.

Step 2: Buy e-Stamp Paper

Visit the Stock Holding Corporation of India (SHCIL) website or authorized banks. Pay the Stamp Duty via Netbanking/RTGS. You will get a unique e-Stamp certificate number.

Step 3: Book SRO Slot

Go to the DORIS website. Enter the e-Stamp number. Select your specific SRO (e.g., Mehrauli, Hauz Khas, Janakpuri). Choose a date and time.

Pro Tip: Book a morning slot (10:00 AM). SRO servers often slow down post-lunch (2:00 PM), and you don't want to be stuck there until evening.

5. The Day of Registration: What to Expect

It’s D-Day. Here is the "Human Logic" timeline of what happens:

9:30 AM: Arrival

Reach the SRO. Parking is always a nightmare at places like the Mehrauli or Pitampura SROs. Take a cab or have a driver drop you. Don't waste energy fighting for parking.

10:00 AM: Entry

Only the Buyer, Seller, and Witnesses are allowed inside. No brokers. The police guard at the door is strict.

11:00 AM: The "Facilitator" Check

A junior officer checks your file. If there is a typo in the name or address, they might ask for a "correction fee" (bribe) or send you back.

Tip: Carry a laptop and printer in your car for last-minute edits if possible. It sounds paranoid, but it saves the deal.

11:30 AM: The Sub-Registrar

You go to the main officer.

Biometrics: Thumbprints and photos are taken via webcam.

Questioning: The officer asks the seller: "Have you received the full payment?" The seller must say "Yes" clearly. If they hesitate, the officer can stop the registration.

7. Common Rejection Reasons at SRO

Imagine waiting 3 hours, reaching the counter, and being told "Come back next week." It happens daily. Here is how to avoid it:

1. The "Name Mismatch" Error

If your PAN card says "Amit Kumar Sharma" and the Sale Deed says "Amit K. Sharma," the officer can reject it. Ensure the name is identical on Aadhaar, PAN, and the Deed. If there is a difference, carry a notarized affidavit explaining it.

2. The "Blurry Witness ID"

Your witnesses must bring original ID proofs. Photocopies are not accepted. If the ID is old and the photo is faded, they might be rejected. Always carry a secondary ID (Driving License/Voter ID) just in case.

3. The "TDS Mismatch"

For deals above ₹50 Lakhs, the TDS certificate (Form 16B) must match the seller's PAN exactly. If you paid TDS on a wrong PAN, the system won't accept it, and you cannot register the deed until you correct it (which takes days).

8. Agent vs. DIY: The "Convenience Fee"

Can you do this yourself? Yes. Should you? That depends on your patience.

The DIY Route

If you go alone, be prepared for "file rejection" for minor reasons. "The margin is too small," "The print is faint," "The witness ID is blurry." It is a test of endurance.

The Agent Route

Most people hire a "Registry Agent" (charges ₹10k - ₹20k). They don't just handle papers; they handle the "ecosystem." They know which clerk needs a smile and which window opens first. If you value your time over ₹15,000, hire one. Just ensure they are verified.

9. Post-Registration: The Job Isn't Over

Walking out with the registered deed is a victory, but you have two more steps.

Collection of Deed

You don't get the original deed immediately. It is scanned and uploaded. You (or your agent) have to collect the original usually later that day or the next day. Keep the receipt safe.

MCD Mutation

Registration makes you the legal owner, but Mutation makes you the "Tax Payer." You must submit the sale deed to the MCD (Municipal Corporation) to change the name in property tax records. Without this, you can't get a water connection or sell the property later.

10. The "Lunch Break" Reality

Government offices in Delhi have a sacred ritual called "Lunch Break." Officially, it is 1:00 PM to 1:30 PM. Practically, it is 1:00 PM to 2:30 PM.

Strategy: If your appointment is after 12:30 PM, bring a book (or a fully charged phone). Nothing moves during this time. No file is checked, no biometric is taken. Do not try to argue with the staff during lunch; it will only delay your file further.

Conclusion

Property registration in Delhi is less about law and more about logistics. It requires preparation, patience, and precise paperwork. Don't leave things to the last minute. Double-check every spelling, every PAN number, and every payment draft. Once the Sub-Registrar signs that document, the property is yours—forever.

Moving in soon? Check our guide on Packers and Movers to sort out your logistics. And if you are buying to rent it out, ensure you read about Rental Agreements.

Frequently Asked Questions (FAQs)

What happens if the seller refuses to come to the SRO?

If you have paid 10% Bayana and signed a registered Agreement to Sell, you can file a suit for "Specific Performance." The court can force the seller to register the property. This is why registering the ATS is crucial.

Can I pay Stamp Duty by Cheque?

No. Stamp Duty is paid via RTGS/NEFT to the Stock Holding Corporation to generate the e-Stamp paper. The Registration Fee is also paid online/via card at the SRO.

Is a lawyer necessary for registration?

Legally, no. Practically, yes. A lawyer ensures the "Title Chain" is mentioned correctly. Mistakes in the legal language can hurt you during resale.

What happens if the seller dies before registration?

If the Agreement to Sell is registered, you can enforce it through court. If it was just a verbal/notarized deal, it becomes a complex legal battle with the heirs.

Can I register property on Saturday?

No. SROs in Delhi are closed on Sundays and Second/Fourth Saturdays. They are open on other Saturdays but usually very crowded.