Ready Reckoner Rates in Mumbai – Area-Wise Guide (2026)

If you think the price of a flat in Mumbai is decided by the buyer and seller, you are only half right. There is a third silent party in every deal: The Government of Maharashtra.

Enter the Ready Reckoner (RR) Rate (also known as the Circle Rate or Guidance Value in other cities). This is the "Minimum Price" assigned by the government to every square inch of land in Mumbai. Whether you are buying a sea-facing penthouse in Worli or a 1BHK in Dahisar, the Stamp Duty you pay is not just based on what you actually pay, but on what the government thinks you should pay.

In 2026, understanding the RR Rate is not just about calculating Stamp Duty. It determines your Income Tax liability (see Capital Gains Tax), the builder's redevelopment premium, and even the "Black vs. White" component of the deal. This guide strips away the technical jargon to explain the Human Logic behind Mumbai's Ready Reckoner system and how it impacts your wallet.

1. What Exactly is the Ready Reckoner Rate?

Imagine you want to sell your flat in Bandra to your cousin for ₹1 Lakh just because you love him. Can you do that?

Technically: Yes.

Legally: The Government says, "Nice try."

The Government assumes that if a property is sold below a certain price, there is "Cash" (Black Money) involved. To prevent this tax evasion, they publish a yearly list—the Annual Statement of Rates (ASR)—which defines the minimum value for every village, zone, and sub-zone.

The Golden Rule of Stamp Duty:

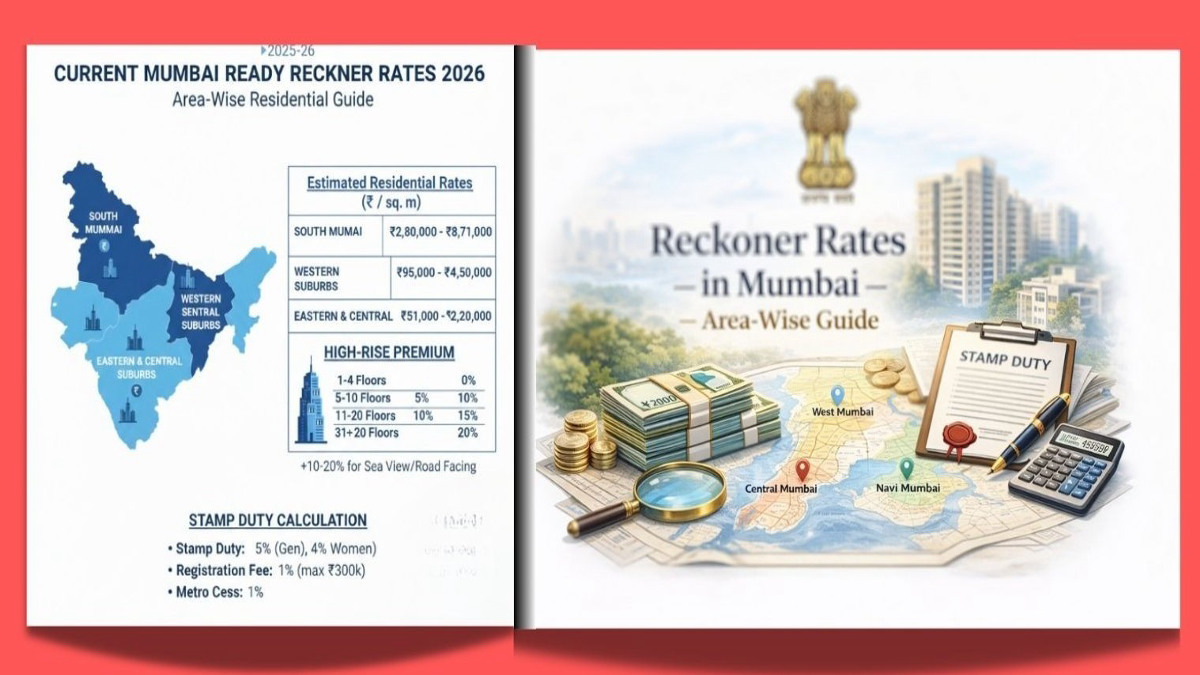

Stamp Duty (currently 6% in Mumbai) is calculated on the

Higher of two values:

- Agreement Value: The price written on your sale deed.

- Ready Reckoner Value: The government-decided price.

Example: You buy a flat for ₹2 Cr. The RR Value is ₹2.5 Cr. You must pay Stamp Duty on ₹2.5 Cr. (Ouch!)

2. The "Double Tax" Trap (Section 43CA & 56(2)(x))

This is where most buyers and sellers get burned. If you buy a flat significantly below the Ready Reckoner rate (e.g., a distress sale or a family transfer), the Income Tax Department wakes up.

For the Buyer (Section 56(2)(x)):

If you buy a property for ₹80 Lakhs, but the RR Value is ₹1 Crore, the difference (₹20 Lakhs) is treated as "Gift Income" or "Income from Other Sources". You have to pay roughly 30% Income Tax on that imaginary ₹20 Lakhs profit.

For the Seller (Section 43CA/50C):

Even if you only received ₹80 Lakhs, the government assumes you sold it for ₹1 Crore. You have to pay Capital Gains Tax on ₹1 Crore.

The Safe Limit: The government allows a variance of up to 10%. If the difference between Agreement Value and RR Value is less than 10%, you are safe. Anything more, and you are walking into a tax trap. (Check our Property Registration Guide for safe value declaration).

3. How to Check Ready Reckoner Rates Online (2026)

You don't need a broker to find the rate. The Department of Registration & Stamps, Maharashtra has a portal called e-ASR. Here is the step-by-step process:

- Visit the IGR Website: Go to igrmaharashtra.gov.in.

- Click on e-ASR: Look for the "e-ASR" (Annual Statement of Rates) tab. select the current year (2025-2026).

- Select District & Taluka:

- For South Mumbai to Sion/Mahim: Select Mumbai City.

- For Bandra to Dahisar / Kurla to Mulund: Select Mumbai Suburban.

- Select Village/Zone: This is tricky. Mumbai is divided into hundreds of "Villages" (Revenue Villages). E.g., Bandra West is "Village Bandra". Andheri West might be "Village Ambivali" or "Village Versova". Check your property tax bill or old agreement to find the "Village Name" and "CTS Number".

- View the Rate: The table will show rates for:

- Land (Open Plot): Per sq. meter.

- Residential (Flat): Per sq. meter.

- Office/Commercial: Per sq. meter.

- Industrial: Per sq. meter.

Note: The rate is usually in Rupees per Square Meter. To convert to Square Feet, divide by 10.764. (Roughly divide by 11 for a quick check).

4. Area-Wise Ready Reckoner Rates (Indicative 2026)

While rates change every few hundred meters, here is a broad range of Residential RR Rates in key Mumbai localities to give you a reality check.

| Locality |

Approx RR Rate (₹/sq.ft) on Built-up |

Market Reality |

| South Mumbai (Cuffe Parade / Colaba) |

₹55,000 - ₹85,000 |

Market rate is often lower or equal to RR in old buildings. |

| Worli / Lower Parel |

₹40,000 - ₹60,000 |

High RR due to luxury towers. |

| Bandra West (Pali Hill / Carter Rd) |

₹45,000 - ₹65,000 |

Market rate is significantly higher (₹80k-₹1L+). |

| Andheri West (Lokhandwala) |

₹22,000 - ₹30,000 |

Market rate is usually 30-40% higher than RR. |

| Ghatkopar East |

₹18,000 - ₹25,000 |

High demand due to Metro/Gujarati community. |

| Borivali / Kandivali |

₹14,000 - ₹20,000 |

Standard suburban rates. |

| Dahisar / Mira Road (MBMC) |

₹8,000 - ₹12,000 |

Affordable belt. |

*Disclaimer: These are approximate ranges based on 2025-26 ASR. Exact rates depend on the specific CTS number and road width.

5. Depreciation: The "Old Building" Benefit

If you are buying a flat in a 40-year-old building, should you pay tax on the same rate as a brand new tower next door?

No. The government allows for Depreciation on the "Construction Component" of the RR value.

The RR Value has two parts: Land Cost + Construction Cost.

You get depreciation only on the Construction Cost (usually 40-50% of the total value), based on the age of the building:

- 0-2 Years: 0% Depreciation

- 5-10 Years: 10% Depreciation

- 20-30 Years: 30% Depreciation

- 60+ Years: Max 70% Depreciation

Real World Tip: To claim this, you must produce the "Completion Certificate" or "Occupation Certificate" (OC) showing the building's age. Without proof, the SRO will charge you the full rate.

6. Why Builders Hate High RR Rates (Redevelopment Logic)

You might think, "High RR rate is good, my property value goes up!"

Not always. If you live in an old society hoping for Redevelopment, a very high RR rate can kill your project.

Builders have to pay "Fungible FSI Premiums", "Development Cess", and "Open Space Deficiency Charges" to the BMC. All these are calculated as a percentage of the Ready Reckoner Rate.

If the RR rate in your area is artificially high (like in some parts of South Mumbai), the premiums become so expensive that the builder's profit vanishes. He will walk away from the redevelopment. This is why many projects in high-RR zones are stuck.

7. The "Carpet vs. Built-up" Confusion

In RERA (post-2017), we sell on Carpet Area.

But the Ready Reckoner is often calculated on Built-up Area (or Carpet x 1.1 or 1.2 factor depending on the year's rule).

The 2026 Calculation Hack:

1. Take your RERA Carpet Area.

2. Add 20% (Loading) to get a "Notional Built-up Area".

3. Multiply by the RR Rate per sq. meter.

Always ask your lawyer to verify the exact "Multiplying Factor" for the current year. It changes.

The Bottom Line: Don't Ignore the Rate

The Ready Reckoner Rate is the silent partner in your property deal. It sets the "Floor Price" of the Mumbai market. It stops prices from crashing too low (because tax makes cheap deals expensive) and it sets the baseline for all government fees. Before you negotiate a price with a seller, check the RR Rate. If the seller is asking for ₹1.5 Cr, but the government says the flat is worth ₹1.8 Cr, you need to have a serious talk about who is going to bear the extra Stamp Duty and Income Tax load. In Mumbai real estate, ignorance is not bliss; it is expensive.

Frequently Asked Questions (FAQs)

Q1: When are RR Rates updated?

Usually on April 1st of every financial year. However, in election years or special situations, the government might keep them unchanged. Always check for the latest "April 1st" circular.

Q2: Can the Market Value be LOWER than RR Value?

Yes. This happens in luxury areas (like Worli/Lower Parel) or during market slumps. If you buy at Market Value (which is lower), you still have to pay Stamp Duty on the higher RR Value. You can appeal to the Collector of Stamps (Adjudication) to prove the lower value, but it is a long, painful process.

Q3: Does floor rise affect RR Rate?

In the standard ASR table, the rate is usually flat for the building. However, for high-rises (skyscrapers), there have been proposals to have floor-rise based RR rates. Currently, in most of Mumbai, the RR rate is uniform for the building regardless of whether you are on the 1st floor or 20th floor, but always verify the specific "Vertical Rule" for the year.

Q4: Is parking included in RR Value?

Yes. If you are buying a closed garage or stilt parking, there is a specific RR rate for parking slots (usually 25% or 40% of the residential rate). This is added to the flat value to get the total valuation.

Q5: What is the "Metro Cess"?

It is a 1% surcharge on Stamp Duty (making it 6% instead of 5%) applicable in Mumbai, Pune, Thane, and Nagpur to fund transport infrastructure projects. It is calculated on the RR Value/Agreement Value.

Disclaimer: Ready Reckoner rates are subject to revision by the Government of Maharashtra. The rates mentioned here are indicative for 2026. Please verify the exact rate for your CTS number on the IGR Maharashtra portal before making financial decisions.