Home Loan in Pune: The "Real" Eligibility & Documentation Guide (2026)

Getting a home loan in Pune isn't just about filling a form. It's a battle between your dream home and the bank's risk team. If you are buying in Baner, Wagholi, or Hinjewadi, the rules change depending on the property type.

Many buyers think, "I have a salary of ₹1.5 Lakhs, I will easily get a loan." Wrong.

Banks don't just fund you; they fund the property. If the property has legal holes (like Gunthewari plots, "Tukda" land, or non-RERA floors), even a billionaire with an 850 CIBIL score won't get a loan on it. Conversely, even if the property is perfect, a single "settled" credit card entry from five years ago can ruin your application.

We skip the textbook definitions found on banking websites. Instead, we give you the street-smart reality of securing a home loan in Pune—from the hidden "APF" codes to the "MOD" charges that surprise you on disbursement day.

1. The "APF" Number: The Golden Ticket

Before you even check your CIBIL score, ask the builder one question: "Do you have an APF Number from SBI or HDFC?"

What is APF? It stands for Approved Project Financial. It is a unique code generated by a bank after their legal team scans the builder's land papers, N.A. orders, and blueprints.

In Pune's market, where land litigation is common, the APF is your safety net.

- If the project has an APF: Your loan will likely be sanctioned in 5-7 days. The bank doesn't need to check the property papers again; they only need to check your financial papers.

- If the project has NO APF: RUN. If a builder doesn't have an APF from a nationalized bank (SBI, Union Bank), there is a skeleton in the closet—likely a land dispute or illegal floor.

Pro Tip: Never rely on "Letters of Intent" from small co-operative banks. Stick to the big players for safety.

2. Eligibility: The "Real" Math (FOIR)

You might think you can afford a ₹60k EMI on a ₹1 Lakh salary. The bank disagrees. They use a brutal formula called FOIR (Fixed Obligation to Income Ratio).

The Rule of Thumb: Banks assume 50% of your income goes into living expenses. They only lend on the remaining 50%.

The "Car Loan" Killer:

If you earn ₹1 Lakh/month, your eligibility is ₹50,000.

BUT, an existing Car Loan EMI of ₹15,000 drops your capacity to ₹35,000.

Reality Check: That innocent ₹15k car EMI reduces your home loan eligibility by nearly ₹18-20 Lakhs!

Advice: Close your car loan or personal loan before applying. It instantly boosts borrowing power.

3. The "CIBIL Score" Myth vs. Reality

Everyone knows you need 750+. But banks now look deeper—at your Credit History Behavior.

The "Settled" Trap

Did you have a credit card dispute 4 years ago where you paid a smaller amount to "settle" the debt? That status appears as "Settled" on your CIBIL report. To a home loan officer, "Settled" means "Defaulted." Major banks like SBI or ICICI will reject your home loan application instantly if they see this flag, even if your current score is 780.

"Credit Hungry" Behavior

If you have applied for 4 personal loans and 3 credit cards in the last 6 months, you look desperate. This "Credit Hungry" behavior lowers your internal score with the bank, leading to a higher interest rate or outright rejection.

4. The "Down Payment" Shock

The Reserve Bank of India (RBI) allows banks to fund up to 80-90% of the property value. But read the fine print carefully. They fund 80% of the Agreement Value.

What they DO NOT fund (The "Out-of-Pocket" Expenses):

- Stamp Duty & Registration: In Pune, this is roughly 7% of the property cost. For a ₹60 Lakh flat, that's ₹4.2 Lakhs straight from your pocket.

- GST: 5% for Under-Construction properties (1% for Affordable Housing).

- Brokerage: If you used an agent (usually 1-2%).

- Legal Fees & Processing Fees: ₹10k - ₹20k.

- Advance Maintenance / Clubhouse Charges: Builders often ask for 2 years of maintenance upfront.

The Truth: You need to have at least 25% to 30% of the total property cost in your own savings account before you sign the deal. If you rely on the loan for everything, you will get stuck at the registration stage.

5. Public vs. Private Banks: Who to Choose?

In Pune, you generally have three categories of lenders. Choosing the right one depends on your patience and your profile.

1. Public Sector Banks (SBI, Union Bank, Bank of Baroda)

- Pros: Lowest interest rates, zero hidden charges, and the "Daily Reducing Balance" method (which saves you money). Most importantly, if SBI approves the property, the title is 100% clean.

- Cons: Slow. They treat you like a student giving an exam. They will ask for papers you didn't know existed. Processing can take 15-30 days.

- Verdict: Best for End-Users who want peace of mind and lowest EMI.

2. Private Banks (HDFC, ICICI, Axis)

- Pros: Fast. They can sanction a loan in 3-5 days. Service is doorstep—the executive will come to your office to collect documents.

- Cons: Slightly higher processing fees. They are stricter on FOIR but slightly more lenient on property deviations than PSU banks.

- Verdict: Best for busy professionals who want speed and convenience.

3. NBFCs (Bajaj, Tata Capital, LIC HFL)

- Pros: They lend where banks won't. If you have a slightly low CIBIL, cash salary components, or are buying a property with minor legal deviations, NBFCs are your savior.

- Cons: Higher interest rates (sometimes 1-2% higher). Pre-payment penalties might exist (check the fine print).

- Verdict: The last resort. Use them only if mainstream banks reject you.

6. The "Co-Applicant" Strategy

Should you add your wife or husband as a co-applicant? In 90% of cases, the answer is YES.

- Eligibility Boost: If both are working, the bank clubs both incomes. A ₹50 Lakh loan capacity suddenly becomes ₹90 Lakhs.

- Interest Rate Discount: Many banks (like SBI) offer a 0.05% discount on the interest rate if the first applicant or co-owner is a woman. It sounds small, but on a ₹50 Lakh loan over 20 years, that saves you roughly ₹40,000.

- Tax Benefits: Both husband and wife can separately claim tax deductions under Section 80C (Principal) and Section 24b (Interest), effectively doubling the tax-saving capacity of the household.

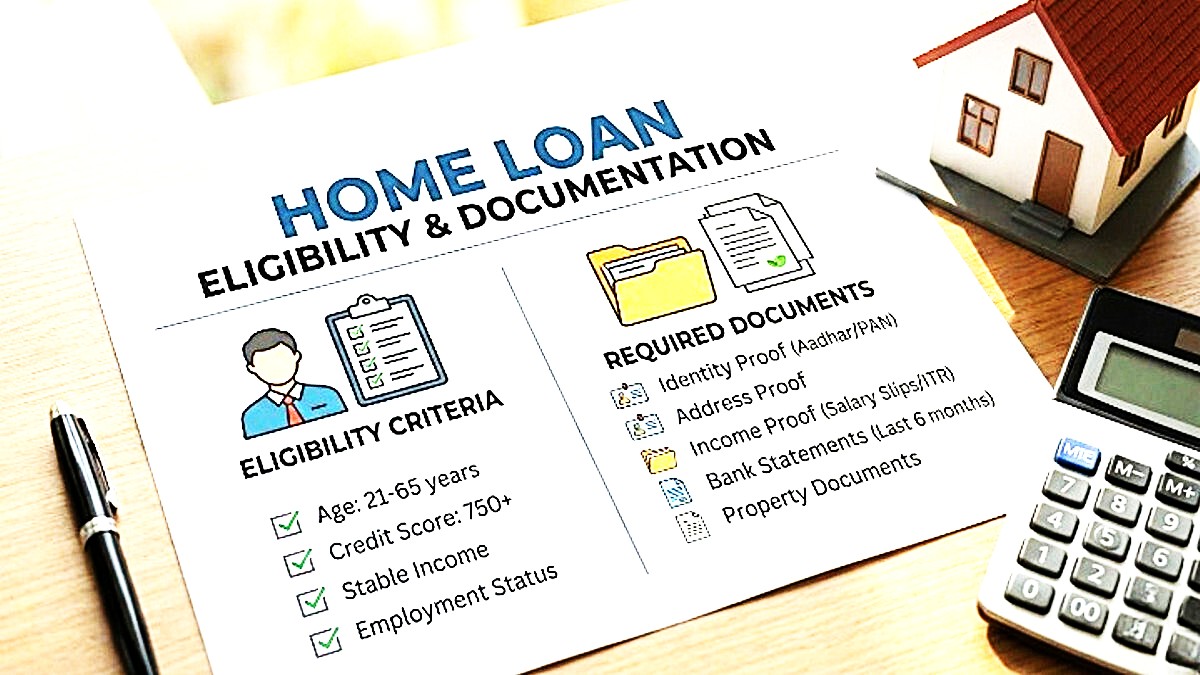

7. Documentation Checklist (The 2026 Standard)

In Pune, the days of "Chalta Hai" documentation are over. One missing paper, and your file goes into the "Hold" pile. Prepare this kit before you apply.

For Salaried (The "Easy" Ones)

- KYC: Aadhaar, PAN (Mandatory).

- Income Proof: Last 3 Months Salary Slips + Form 16 (Last 2 Years).

- Bank Statement: Last 6 Months of the Salary Account.

Warning: If your salary slip says ₹50k but the bank credit is ₹48k (due to deductions), be ready to explain. Matches must be exact.

- Job Continuity: If you joined a new job 2 months ago, you need the Relieving Letter from the previous company to prove you didn't have a gap.

- Address Proof: Current Rent Agreement (if living on rent).

For Self-Employed (The "Tough" Ones)

- ITR: Last 3 Years (Not just the acknowledgment page, but the full Computation of Income).

- Financials: Profit & Loss (P&L) and Balance Sheet certified by a CA.

- Business Proof: Shop Act / Udyam Aadhar / GST Certificate (Must be at least 3 years old).

- Bank Statements: Current Account (1 Year) + Savings Account (6 Months).

- Vintage Proof: Banks want to see you have been in business for at least 3-5 years.

8. The "Resale" Property Nightmare

Buying a used flat in established areas like Kothrud, Viman Nagar, or Aundh? The bank will demand the "Chain of Agreements".

If the flat has been sold 4 times in the last 20 years, you need the original Registered Agreement of ALL 4 previous sales. If the 1st owner's agreement from 1998 is missing, NO BANK will fund it.

Search Report: For resale, you (or the bank) will need to hire a lawyer to generate a 30-year Search Report from the Sub-Registrar's office to ensure the title is clear and there are no mortgages on the property. Don't skip this.

9. Gunthewari & NA Plots

Pune is famous for "Gunthewari" plots (small unauthorized layouts carved out of agricultural land). Agents will often tell you, "Sir, Loan ho jayega" (Loan will happen) from a small co-operative bank.

My Advice: Avoid it. Nationalized banks (SBI, HDFC, ICICI) do not fund Gunthewari or agricultural plots for a reason. If the top banks reject a property, it's because the title is risky. Don't take a high-interest loan from a small pat-sanstha just to buy a legal headache. Stick to NA (Non-Agricultural) plots with a Sanctioned Layout.

10. Hidden Charges No One Tells You

The interest rate isn't the only cost. Be ready for these surprises on the day of disbursement:

- MOD (Memorandum of Deposit of Title Deed): In Maharashtra, you have to pay 0.3% of the loan amount as Stamp Duty for depositing your property papers with the bank. For a ₹50 Lakh loan, that's ₹15,000. This is mandatory.

- Processing Fee: Usually 0.5% to 1% of the loan amount + GST. (Negotiate this! Banks often waive it during festive offers).

- CERSAI Charges: A nominal fee (₹500) to register the loan in the central database to prevent fraud.

- Property Insurance: Banks will aggressively push you to buy property insurance and loan insurance (to cover the loan if you die). While property insurance is good, loan insurance is often overpriced. Compare with external term insurance before signing.

11. How to Pre-Pay and Kill the Loan

A home loan is a 20-year commitment, but you shouldn't let it run for 20 years. In the first 5 years, your EMI is mostly Interest, not Principal.

The "One Extra EMI" Rule: If you pay just one extra EMI per year as a principal pre-payment, you can reduce your loan tenure from 20 years to roughly 12-13 years. Use your annual bonus to knock off the principal. The earlier you do this, the more interest you save.

Conclusion

Getting a home loan in Pune is a process of elimination. You eliminate the bad properties (no APF), you eliminate the bad debts (car loans), and you eliminate the bad lenders (shady co-operative banks). Treat the bank as your Free Legal Advisor. If a strict bank like SBI rejects a property, don't try to find a "setting" with another bank. Thank them for saving you from a bad deal. In the long run, a clean loan on a clean property is the only asset that truly creates wealth.

Frequently Asked Questions (FAQs)

Q: Can I get a 100% Home Loan?

A: No. It is illegal for banks to fund 100%. The max is 90% for loans under ₹30 Lakhs, and 80% for loans above ₹75 Lakhs. You must arrange the rest.

Q: Is a Fixed Rate or Floating Rate better?

A: Always choose Floating Rate. Fixed rates are usually 2-3% higher and come with heavy pre-payment penalties. Floating rates allow you to pre-pay without penalty.

Q: What if I have a cash salary?

A: Major banks won't touch it. You will have to approach an NBFC or a specialized Affordable Housing Finance Company (like Aavas or Gruh), but be prepared for 11-13% interest rates.

Q: How long does the sanction letter stay valid?

A: Usually 6 months. If you don't disburse the loan within 6 months, you have to pay the processing fee and do the KYC again.

Q: Can I switch my loan from HDFC to SBI later?

A: Yes, this is called a "Balance Transfer." If SBI offers a lower rate after 2 years, you can shift your loan. However, calculate the processing fees and MOD charges again to see if it's worth the hassle.